SSI 2026: 3.2% Increase & Payment Optimization

The projected 3.2% increase in Supplemental Security Income (SSI) for 2026 aims to help beneficiaries manage rising costs, requiring strategic planning to optimize monthly payments effectively.

For millions of Americans relying on Supplemental Security Income (SSI) 2026: A 3.2% Increase and How to Optimize Your Monthly Payments (RECENT UPDATES, FINANCIAL IMPACT), understanding the latest developments is crucial. The anticipated 3.2% increase for 2026 represents a significant adjustment designed to help beneficiaries cope with evolving economic landscapes. This article delves into what this increase means for your finances and offers practical strategies to maximize your monthly benefits.

Understanding the 3.2% SSI Increase for 2026

The projected 3.2% increase in Supplemental Security Income (SSI) for 2026 is a vital adjustment aimed at helping beneficiaries maintain their purchasing power amidst inflation. This annual cost-of-living adjustment (COLA) is a mechanism through which the Social Security Administration (SSA) attempts to keep pace with the rising cost of goods and services, ensuring that the financial support provided retains its real value over time.

While the exact percentage of the COLA is determined by economic data from the third quarter of the preceding year, projections offer a strong indication of what beneficiaries can expect. This 3.2% figure is based on current economic forecasts, reflecting trends in inflation and consumer prices. For individuals and families who depend on SSI, this increase can translate into tangible improvements in their monthly budgets, offering a bit more breathing room for essential expenses.

What drives the COLA determination?

The COLA is primarily driven by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. When the CPI-W shows an increase, it signals that the cost of living has gone up, prompting a COLA to be applied to Social Security benefits, including SSI.

- Inflationary Pressures: Rising costs for food, housing, and healthcare are key contributors.

- Economic Indicators: Broader economic trends and forecasts influence the final determination.

- Congressional Mandate: The annual adjustment is a statutory requirement to protect beneficiaries.

Understanding the basis of the COLA helps beneficiaries appreciate why these adjustments are made and how they are designed to support financial stability. The 3.2% increase for 2026 is a direct response to the economic realities faced by many low-income individuals, providing a necessary boost to their monthly income.

In essence, the 2026 SSI increase is more than just a number; it’s a reflection of ongoing efforts to ensure that the most vulnerable populations can continue to meet their basic needs. Beneficiaries should view this adjustment as an opportunity to reassess their budgets and plan for how these additional funds can best be utilized to enhance their quality of life.

Eligibility for Supplemental Security Income (SSI)

Supplemental Security Income (SSI) is a federal program designed to provide financial assistance to adults and children with disabilities or blindness who have limited income and resources, and to people aged 65 or older without disabilities who meet the financial limits. Understanding the eligibility criteria is the first step for anyone considering applying or for current beneficiaries to ensure continued compliance.

The program is distinct from Social Security Disability Insurance (SSDI), though both are administered by the Social Security Administration. SSI is needs-based, meaning eligibility is determined by an individual’s financial situation rather than their work history. This distinction is crucial, as it impacts how income and resources are evaluated.

Key eligibility requirements

To qualify for SSI, applicants must meet several stringent requirements related to age, disability, income, and resources. These criteria are in place to ensure that the program targets those most in need of financial support.

- Age or Disability: Applicants must be 65 or older, or blind, or have a qualifying disability. The SSA has specific definitions for blindness and disability, often requiring medical documentation.

- Limited Income: Your countable income must not exceed the federal benefit rate (FBR). Not all income counts, and certain exclusions apply, which can be complex to navigate.

- Limited Resources: Your countable resources (assets like cash, bank accounts, stocks, and property you own) must not exceed $2,000 for an individual or $3,000 for a couple.

Beyond these primary requirements, there are also residency stipulations. Generally, individuals must be U.S. citizens or nationals, or certain non-citizens who meet specific criteria. Understanding these nuances is essential for a successful application or for maintaining eligibility.

The SSA continually reviews its policies and procedures to ensure the program’s integrity. Potential applicants are encouraged to gather all necessary documentation, including medical records, financial statements, and proof of identity, before initiating the application process. For existing beneficiaries, it’s vital to report any changes in income, resources, living arrangements, or disability status promptly, as these can affect eligibility and benefit amounts.

Optimizing Your Monthly SSI Payments

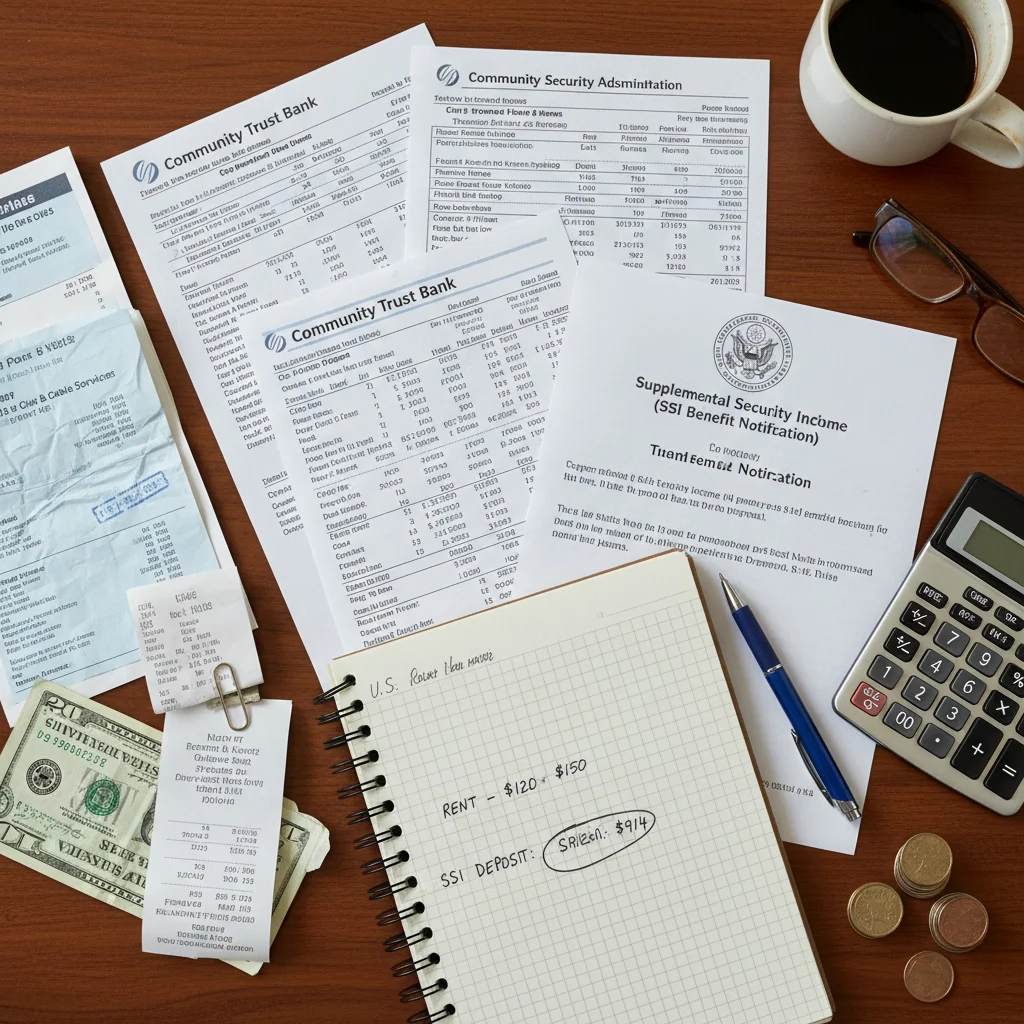

Maximizing your Supplemental Security Income (SSI) payments goes beyond simply receiving the monthly check; it involves strategic planning and a thorough understanding of the program’s rules. With the 3.2% increase projected for 2026, now is an opportune time to review your financial situation and identify ways to optimize your benefits.

One of the most critical aspects of optimizing SSI payments is managing your countable income and resources effectively. SSI is a needs-based program, meaning even slight changes in your financial circumstances can impact your monthly benefit amount. Being proactive and informed can make a significant difference in your financial stability.

Strategies for maximizing benefits

Several strategies can help beneficiaries optimize their SSI payments. These often involve understanding what income and resources are excluded from SSA’s calculations, as well as being aware of various work incentives and deductions.

- Understand Income Exclusions: Not all income counts towards the SSI limit. For example, the first $20 of most income and the first $65 of earned income plus half of the remainder are generally excluded. Understanding these exclusions can help you manage part-time work or other income sources without significantly reducing your benefits.

- Utilize Work Incentives: The SSA offers several work incentives for disabled individuals receiving SSI, such as Impairment-Related Work Expenses (IRWE), Blind Work Expenses (BWE), and Plans to Achieve Self-Support (PASS). These allow you to set aside money for work-related expenses or educational goals without it counting against your resource limit.

- Manage Resources Wisely: The resource limit is strict ($2,000 for individuals, $3,000 for couples). Certain assets are excluded, such as your primary residence, one vehicle, and household goods. Consider ABLE accounts for disability-related expenses, which allow individuals with disabilities to save money without affecting their SSI eligibility.

Careful budgeting and financial planning are also essential. Keep meticulous records of all income and expenses. Regularly review your bank statements and other financial documents to ensure accuracy and identify any potential issues that could affect your benefits.

Additionally, seeking advice from a financial planner specializing in government benefits or a benefits counselor can provide personalized strategies tailored to your specific situation. They can help navigate complex rules and ensure you are taking full advantage of all available opportunities to optimize your SSI payments.

Recent Updates and Their Financial Impact

The landscape of Supplemental Security Income (SSI) is dynamic, with ongoing updates and policy adjustments that can significantly impact beneficiaries. Beyond the projected 3.2% increase for 2026, it’s crucial to stay informed about other recent changes that could affect your monthly payments and overall financial well-being.

These updates often stem from legislative changes, economic shifts, or administrative decisions by the Social Security Administration (SSA). Understanding their implications is key to proactive financial planning and ensuring you continue to receive the maximum benefits you are entitled to.

Key policy changes and their effects

Several recent updates have been implemented or are under consideration, each with distinct financial impacts for SSI recipients. Keeping abreast of these changes allows beneficiaries to adjust their strategies accordingly.

- Increased Resource Limits: While the primary resource limits for individuals and couples have remained stable for some time, there are often discussions and proposals for increases to better reflect modern living costs. Any such increase would allow beneficiaries to hold more assets without jeopardizing their eligibility.

- Changes to Income Disregards: The SSA periodically reviews and adjusts the amounts of income that are disregarded when calculating SSI benefits. For example, if the general income exclusion or earned income exclusion amounts were to increase, it could allow beneficiaries to earn more without a proportional reduction in their SSI payments.

- Digital Communication Initiatives: The SSA is increasingly moving towards digital communication. While not directly financial, this can impact how beneficiaries receive important notices about their benefits, COLA adjustments, and reporting requirements. Ensuring access to and understanding of these digital platforms is vital.

Another area of focus has been on simplifying the reporting process for income and resources. Efforts to streamline these procedures aim to reduce the burden on beneficiaries and minimize errors that could lead to overpayments or underpayments. Staying informed about simplified reporting methods can prevent potential financial complications.

The financial impact of these updates can vary widely depending on individual circumstances. For some, a slight adjustment in income disregards could mean the difference between maintaining a certain level of benefit and seeing a reduction. For others, an increase in resource limits could open up new avenues for saving or managing assets without penalty. Continuous engagement with SSA resources and reliable news sources is crucial for navigating these changes effectively.

Navigating the Application Process for SSI

For those new to Supplemental Security Income (SSI), the application process can appear daunting. However, with careful preparation and a clear understanding of the steps involved, it is a manageable journey. The goal is to provide the Social Security Administration (SSA) with all the necessary information to determine your eligibility accurately and efficiently.

The SSA aims to make the application process as accessible as possible, offering various methods to apply and support throughout. Knowing what to expect and how to best present your case can significantly smooth the path to receiving benefits.

Steps to a successful SSI application

A successful SSI application hinges on meticulous documentation and a clear understanding of what the SSA requires. Here are the key steps to navigate the process effectively:

- Gather Required Documents: Before you even start the application, compile all essential documents. This includes proof of age (birth certificate), citizenship or legal residency, Social Security card, income and resource statements (bank statements, pay stubs, deeds), medical records detailing your disability or blindness, and information about your living arrangements.

- Initiate the Application: You can apply for SSI online for adults who are not filing for disability benefits, by phone, or in person at your local Social Security office. For disability applications, you will typically need to complete an interview. Be prepared to answer detailed questions about your health, work history, and financial situation.

- Medical Review (for Disability/Blindness): If applying due to disability or blindness, your application will undergo a thorough medical review by Disability Determination Services (DDS) in your state. They will evaluate your medical evidence to determine if your condition meets the SSA’s definition of disability.

- Financial Review: The SSA will also review your income and resources to ensure they fall within the program’s limits. This includes all forms of income, such as wages, pensions, and other government benefits, as well as assets like bank accounts and property.

It is important to be completely honest and thorough in your application. Any discrepancies or missing information can cause significant delays. If you require assistance, the SSA provides resources, and many non-profit organizations offer free help with the application process.

After submitting your application, be patient. The process can take several months, especially if a disability determination is required. Respond promptly to any requests for additional information from the SSA. If your application is denied, you have the right to appeal the decision, and it is often advisable to seek professional assistance for appeals.

Impact of Inflation and Economic Trends on SSI

The economic landscape, particularly inflation and broader economic trends, plays a pivotal role in shaping the value and adequacy of Supplemental Security Income (SSI) payments. The projected 3.2% increase for 2026 is a direct reflection of these forces, underscoring the continuous challenge of ensuring that benefits keep pace with the rising cost of living.

Inflation erodes purchasing power, meaning that even if your benefit amount remains constant, its real value decreases over time. This is precisely why the annual Cost-of-Living Adjustment (COLA) is so crucial for SSI recipients, acting as a buffer against economic erosion.

How inflation affects beneficiaries

For SSI beneficiaries, who often live on fixed incomes, inflation presents unique challenges. The costs of essential goods and services, such as food, housing, utilities, and healthcare, tend to rise over time. When benefits do not keep pace, beneficiaries can find it increasingly difficult to cover their basic needs.

- Erosion of Purchasing Power: Every dollar received buys less as prices increase, leading to a squeeze on household budgets.

- Increased Cost of Essentials: Food and housing, which constitute a significant portion of expenses for low-income individuals, are particularly susceptible to inflationary pressures.

- Healthcare Expenses: Medical costs continue to rise, and even with government assistance, out-of-pocket expenses can be a major burden for many SSI recipients.

The 3.2% COLA for 2026 is an attempt to mitigate some of these effects, but it’s important to recognize that the COLA calculation is based on an average consumer price index, which may not perfectly reflect the spending patterns and cost increases experienced by all SSI recipients. For instance, if healthcare costs rise significantly more than other goods, beneficiaries with high medical needs might still feel a pinch despite the COLA.

Beyond inflation, broader economic trends such as wage growth, employment rates, and interest rates can indirectly affect SSI beneficiaries. A strong economy with higher wages might lead to more opportunities for those capable of working part-time, but it can also drive up the cost of living faster. Conversely, economic downturns can exacerbate financial hardship for vulnerable populations.

Therefore, understanding the interplay between SSI payments, inflation, and economic trends is not just an academic exercise; it’s a practical necessity for beneficiaries to plan their finances effectively and advocate for policies that truly meet their needs. The 2026 increase is a step, but continuous vigilance and adaptation remain vital.

Future Outlook for SSI: Projections and Advocacy

Looking ahead, the future of Supplemental Security Income (SSI) involves a complex interplay of economic projections, legislative considerations, and ongoing advocacy efforts. The 3.2% increase for 2026, while a positive adjustment, is part of a broader conversation about the long-term sustainability and adequacy of the program.

Policymakers, advocates, and beneficiaries alike are constantly evaluating how SSI can best serve its intended purpose in an evolving economic and social landscape. Understanding these future prospects is essential for all stakeholders.

Long-term projections and advocacy efforts

Several factors will shape the future trajectory of SSI, including demographic shifts, economic forecasts, and the political will to enact reforms. Long-term projections often highlight the need for adjustments to ensure the program remains effective.

- Demographic Changes: An aging population and evolving disability rates will continue to influence the number of SSI beneficiaries and the overall cost of the program.

- Economic Volatility: Future inflation rates and economic growth will dictate the necessity and size of future COLAs, impacting the real value of benefits.

- Legislative Reforms: There are ongoing discussions and proposals in Congress to modernize SSI. These reforms often aim to increase benefit adequacy, update resource limits, and simplify complex rules that can create barriers for beneficiaries.

Advocacy groups play a critical role in championing the needs of SSI recipients. They work to raise awareness about the challenges faced by low-income individuals with disabilities and seniors, pushing for policy changes that would enhance the program’s effectiveness. Key areas of advocacy often include increasing the federal benefit rate, adjusting resource limits to reflect current economic realities, and improving work incentives.

For beneficiaries, staying informed about these discussions and participating in advocacy efforts, where possible, can be empowering. Even small actions, such as contacting elected officials or supporting relevant organizations, can contribute to a stronger voice for SSI recipients.

The future outlook for SSI is not static; it is a continuously developing narrative influenced by many factors. While the 3.2% increase for 2026 provides immediate relief, the broader conversation about ensuring a dignified and financially secure future for all SSI beneficiaries will continue to be a priority for years to come. Engaged citizenship and informed participation are vital to shaping this future.

| Key Point | Brief Description |

|---|---|

| 3.2% Increase 2026 | Projected cost-of-living adjustment (COLA) for Supplemental Security Income payments, aiming to counter inflation. |

| Eligibility Criteria | Requirements based on age (65+), blindness, disability, and strict income/resource limits ($2k individual, $3k couple). |

| Payment Optimization | Strategies include understanding income exclusions, utilizing work incentives (IRWE, PASS), and managing resources wisely (ABLE accounts). |

| Financial Impact | COLA helps combat inflation, but ongoing economic trends and policy updates require beneficiaries to stay informed and adapt. |

Frequently asked questions about SSI 2026

The projected Supplemental Security Income (SSI) increase for 2026 is 3.2%. This adjustment, known as a Cost-of-Living Adjustment (COLA), aims to help beneficiaries keep pace with inflation and the rising cost of essential goods and services. The final percentage is officially announced later in the year, based on economic data.

The SSI COLA is primarily determined by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The Social Security Administration (SSA) compares the CPI-W from the third quarter of the current year to the third quarter of the previous year. An increase in this index leads to a corresponding COLA.

For SSI eligibility, countable income must be below the Federal Benefit Rate (FBR), and countable resources must not exceed $2,000 for an individual or $3,000 for a couple. Certain types of income and assets are excluded from these calculations, such as your primary home and one vehicle.

Yes, you can work while receiving SSI benefits. The Social Security Administration (SSA) has various work incentives, such as Impairment-Related Work Expenses (IRWE) and Plans to Achieve Self-Support (PASS), designed to encourage work and self-sufficiency without immediately terminating benefits. Only a portion of your earned income counts against your SSI.

Optimizing SSI payments involves understanding income exclusions, utilizing work incentives, and managing resources carefully. Consider setting up an ABLE account for disability-related expenses, which allows savings without impacting eligibility. Regularly report changes in income or living arrangements to the SSA to ensure accurate benefit amounts.

Conclusion

The projected 3.2% increase in Supplemental Security Income (SSI) for 2026 marks a crucial adjustment for millions of beneficiaries across the United States. This cost-of-living adjustment is a testament to the ongoing efforts to ensure that SSI payments retain their value against the backdrop of inflation and rising living expenses. However, merely receiving this increase is only one part of the equation. True financial stability for SSI recipients hinges on a deep understanding of eligibility criteria, proactive management of income and resources, and staying informed about recent policy updates. By strategically navigating these aspects, beneficiaries can optimize their monthly payments, enhance their financial well-being, and face the future with greater confidence.