Savings account comparison: find the best options for you

To maximize your savings, set clear goals, automate transfers, use high-yield accounts, and regularly review your expenses for unnecessary costs.

Savings account comparison is essential for anyone looking to make the most of their money. With so many options out there, how do you choose the right one for your financial goals? Let’s dive into what you need to know.

Understanding different types of savings accounts

There are many types of savings accounts, and understanding them can help you make better financial choices. Each type has its own benefits and drawbacks. Let’s explore the most common types of savings accounts so you can find the one that suits your needs best.

Basic Savings Accounts

A basic savings account is the most common type. They offer easy access to your funds and usually come with low minimum balance requirements. However, the interest rates may not be very high.

High-Yield Savings Accounts

If you want to earn more interest on your savings, consider a high-yield savings account. These accounts typically offer higher interest rates than basic ones, thanks to online banks that have lower overhead costs. These accounts may require a higher minimum balance.

- Higher interest rates than traditional accounts

- May require a minimum balance

- Usually offered by online banks

Money Market Accounts

Money market accounts are another option. They often combine features of checking and savings accounts. You can earn interest while having limited check-writing capabilities. However, they usually require a higher minimum deposit.

Certificates of Deposit (CDs)

Certificates of Deposit, or CDs, are a safe way to save money for a fixed period. They offer higher interest rates in exchange for keeping your money locked away for a specific term. Early withdrawal may incur penalties, so it’s essential to plan accordingly.

- Fixed interest rates

- Penalties for early withdrawal

- Safe investment option

Understanding the different types of savings accounts is crucial for growing your savings. Each type serves a specific purpose and can fit different financial goals. Choose the one that aligns with your needs and watch your money grow.

Key features to consider in a savings account

When choosing a savings account, it’s important to know what features to look for. Understanding key aspects can help you select the account that meets your financial goals.

Interest Rates

Interest rates are a vital factor. The higher the interest rate, the more your savings can grow over time. Look for accounts that offer competitive rates. Certain types of accounts, like high-yield savings accounts, often provide better rates than traditional ones.

Fees

It’s also crucial to consider account fees. Some banks charge monthly maintenance fees or withdrawal fees. Look for accounts that are low-cost or even free. This can help you keep more of your savings intact.

- Monthly maintenance fees

- Withdrawal limits and fees

- Minimum balance requirements

Access to Funds

Another important feature is access to your funds. Some savings accounts offer easy access to your money through ATM withdrawals or online banking. Make sure the account you choose fits your needs for convenient access.

Minimum Balance Requirements

Many accounts have a minimum balance requirement to avoid fees or to earn interest. Be sure to check these requirements. If you find it challenging to maintain a minimum balance, look for accounts with lower thresholds or no minimum.

- Minimum balance to avoid fees

- Minimum balance to earn interest

- Flexibility in maintaining balance

By considering these key features, you can choose a savings account that reflects your financial habits and goals. Pay attention to interest rates, fees, and access to funds as you make your decision.

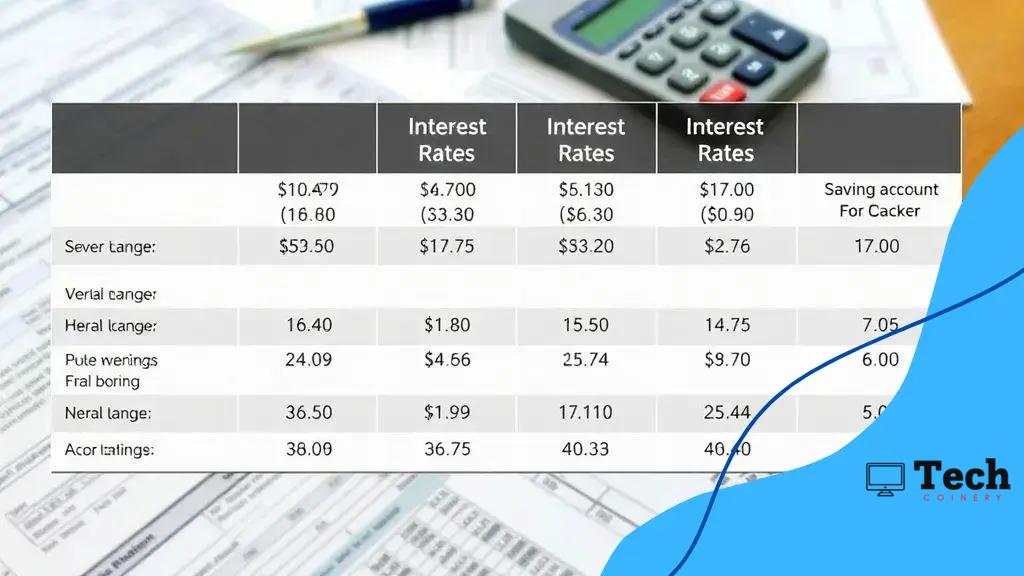

Comparing interest rates and fees

When it comes to savings accounts, comparing interest rates and fees is essential for maximizing your savings. This process can help you find the best account for your financial needs.

Understanding Interest Rates

Interest rates determine how much money you earn on your deposits. A higher interest rate can significantly affect your savings over time. When comparing rates, look for accounts that offer competitive annual percentage yields (APY). Different banks may provide varying rates, so always shop around.

Types of Fees

Fees can eat into your earnings, making it important to understand the types you might encounter. Common fees include:

- Monthly maintenance fees for keeping the account open

- Fees for excess withdrawals or transactions

- Early closing fees if you close the account too soon

- Minimum balance fees if your account falls below a set limit

When selecting a savings account, it’s not just about the interest rate. Consider how fees will impact your overall savings. Some accounts offer no fees for maintaining a balance or have options to waive fees based on your activity.

The Impact of Fees on Your Earnings

Even small fees can add up quickly, reducing your savings growth. For example, a monthly fee of $5 translates to $60 a year, which can significantly affect your returns. Pairing a high-interest account with low fees will maximize your earnings.

Ultimately, make sure to carefully review both the interest rates and the potential fees associated with savings accounts. This strategy will empower you to make informed decisions about where to keep your money.

The role of online banks in savings

Online banks play a significant role in the world of savings accounts today. They offer unique benefits that traditional banks can’t always match. Understanding how these banks work can help you choose the best option for your finances.

Higher Interest Rates

One of the most attractive features of online banks is their ability to offer higher interest rates on savings accounts. Because they have lower overhead costs due to fewer physical branches, they can pass these savings on to customers. This can mean more growth on your savings over time.

Lower Fees

Online banks often charge fewer or no fees for account maintenance. This is advantageous because it allows you to keep more of your interest earnings. Understanding fee structures is crucial. With no monthly maintenance fees, you can grow your savings without unnecessary costs.

- No monthly maintenance fees

- Fewer transaction fees

- Options for fee waivers based on account activity

Convenient Access

Even though online banks don’t have physical locations, they provide many convenient ways to access your money. Most offer robust mobile apps and online banking platforms that let you manage your account easily and securely. With features like mobile check deposits and online transfers, handling your finances has never been easier.

Customer Service Options

While some people worry about lack of direct contact, many online banks offer excellent customer service through various channels. You can often reach them via phone, chat, or email, providing quick assistance with any issues. This is an important aspect to consider when choosing an online bank.

With their higher interest rates, lower fees, and convenient access, online banks are becoming a popular choice for savers. Evaluating what each bank offers will help ensure that you make the best decision for your savings needs.

Tips for maximizing your savings

Maximizing your savings is easier with the right strategies. Implementing a few simple tips can help grow your money faster. Let’s explore effective ways to enhance your savings.

Set Clear Savings Goals

Setting clear savings goals gives you something to work towards. Whether it’s a vacation, a new car, or an emergency fund, having specific targets motivates you to save more. Make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Automate Your Savings

Automating your savings is a great way to ensure you save consistently. You can set up automatic transfers from your checking account to your savings account. This way, you save a certain amount each month without even thinking about it.

- Choose a fixed amount to transfer each month

- Schedule transfers right after payday

- Adjust the amount as your financial situation changes

Take Advantage of High-Yield Accounts

Using a high-yield savings account can significantly improve your savings growth. These accounts typically offer higher interest rates than standard savings accounts. By comparing different options, you can find an account that provides better returns on your deposits.

Review and Reduce Unnecessary Expenses

Analyzing your monthly expenses is crucial. Identify areas where you can cut back. Reducing unnecessary expenses will free up more money for savings. Whether it’s dining out less or canceling unused subscriptions, small changes can add up quickly.

Lastly, keep track of your savings progress. Regularly reviewing your goals and monitoring your accounts can motivate you to continue saving. Staying aware of your financial situation is key to maximizing your savings successfully.

In conclusion, maximizing your savings is all about using the right strategies and tools. By setting clear goals, automating your savings, and using high-yield accounts, you can grow your money more efficiently. Keeping an eye on your expenses and reviewing your financial goals regularly further enhances your savings journey. Remember, the sooner you start, the more you can earn over time!

FAQ – Frequently Asked Questions about Maximizing Savings

What are the benefits of setting savings goals?

Setting savings goals gives you clear targets to work towards, motivating you to save more effectively.

How can automating my savings help me?

Automating your savings ensures that a portion of your income is consistently set aside, making it easier to reach your financial goals.

Why should I consider high-yield savings accounts?

High-yield savings accounts typically offer better interest rates than traditional accounts, allowing your savings to grow faster.

What strategies can I use to identify unnecessary expenses?

Review your monthly spending habits to pinpoint areas where you can cut back, such as subscriptions or dining out less.